New rules have been put in place for reporting and making payment of Capital Gains Tax for all UK residential property disposals completing since 6th April 2020. This new rule states that the reporting and payment for CGT must be made within 30 days.

If you are making disposals or considering selling a UK residential property, please allow sufficient time for a return to be prepared and submitted (if required) within the restricted timescale and avoid late filing penalties.

Calculating the notion CGT payable

If a return is required, a calculation of the notional CGT must be made and a return submitted to HMRC, together with the payment of the tax, within 30 days of the date of completion.

The calculation must be a 'reasonable estimate' of the CGT that will be due, taking into account the taxpayers estimated income for the fiscal year and any previous UK residential property disposals in the fiscal year. Factors such as brought forward losses and other reliefs also need consideration.

Care must be taken with 'reasonable estimates' as any underestimate due to a careless error will result in interest and possible penalties. There may be difficulties where the base cost for the property is hard to ascertain, e.g. property acquired as a result of gift or inheritance, and also where an individual's annual income is volatile.

If you have anticipated Capital Gains Tax as a result of your disposal, we highly recommend you seek advice from your accountant.

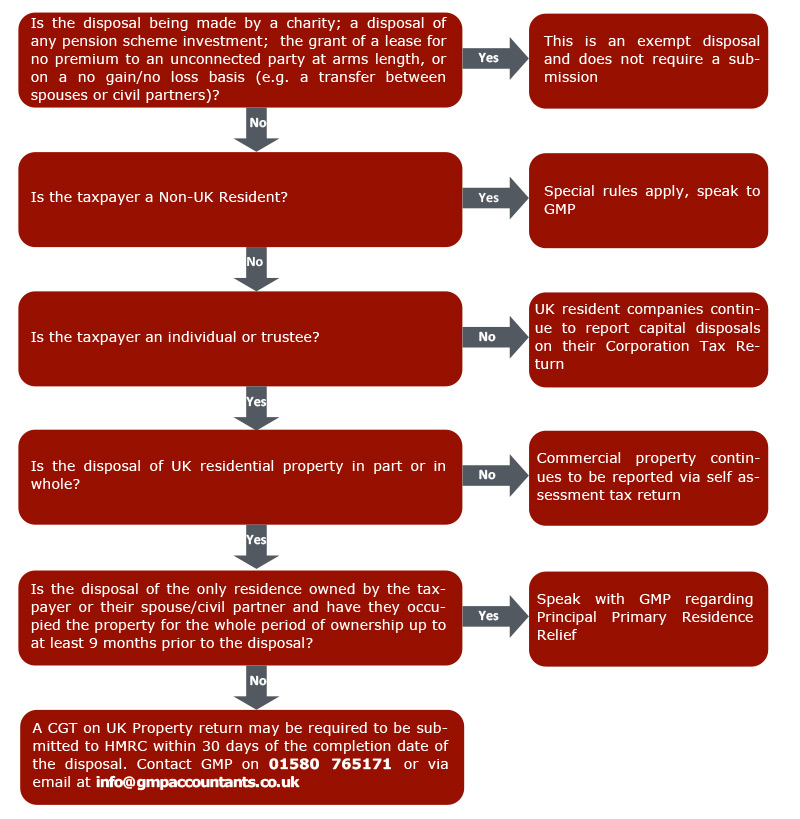

Who is required to submit a CGT on UK Property return?

Tax planning

One of the more contentious aspects of the new rules regards the offsetting of capital losses. This may lead to unfairness in cash flow to the taxpayer and therefore the timing of capital disposals in the fiscal year is more important than ever.

If you are planning to make several disposals during the fiscal year, we recommend a discussion with your accountant.

Non-resident Individuals and Trustees

All non-UK resident individuals and trustees making UK property disposals, whether direct or indirect, must submit a CGT on UK Property return for all completions as of 6 April 2020.

There will no longer be the ability to defer payment of CGT via the taxpayer's self-assessment return, and any tax owed must be paid within the 30-day reporting period. For individuals, this marks a significant change from the previous fiscal year which may be overlooked, resulting in late-filing, penalties and interest.

Furthermore, in contrast to UK residence, non-residence will be required to submit a CGT on UK Property return even for no gain/no loss transactions despite no tax being due. Again, this could be overlooked which could result in late-filing penalties.

If you want to discuss the new requirements or if you need a CGT on UK Property return submission, please get in touch.